Sales Tax in California: 7 Shocking Facts You Must Know

Navigating the sales tax in California can feel like decoding a complex puzzle. From fluctuating rates to confusing rules, understanding how it impacts your wallet is essential—whether you’re a shopper, business owner, or just curious.

Sales Tax in California: An Overview

The sales tax in California is one of the highest in the United States, and it’s not just a single flat rate. Instead, it’s a layered system combining state, county, city, and district taxes. This means the rate you pay can vary significantly depending on where you are in the state. As of 2024, the base state sales tax rate is 7.25%, but with local additions, the total can exceed 10.5% in some areas.

What Is Sales Tax?

Sales tax is a consumption tax imposed by the government on the sale of goods and services. It’s typically collected by retailers at the point of sale and then remitted to the appropriate tax authority. In California, this responsibility falls under the California Department of Tax and Fee Administration (CDTFA), which oversees the collection and enforcement of sales and use taxes.

- Sales tax applies to tangible personal property and certain services.

- It is generally not applied to unprepared food, prescription medications, and some medical devices.

- The tax is destination-based, meaning it’s based on where the buyer receives the goods.

How California’s Sales Tax System Works

California uses a hybrid model of state and local sales taxes. The state sets a minimum rate, but local jurisdictions—including cities, counties, and special districts—can add their own taxes on top. This creates a patchwork of rates across the state. For example, while Los Angeles County might have a combined rate of 9.5%, a rural county could be closer to 7.75%.

“The complexity of California’s sales tax system is a reflection of its diverse local economies and funding needs.” — California Department of Tax and Fee Administration

Understanding this structure is crucial for businesses that operate in multiple locations or sell online to California residents. The CDTFA provides a comprehensive tax rate lookup tool to help determine the correct rate for any given ZIP code.

sales tax in california – Sales tax in california menjadi aspek penting yang dibahas di sini.

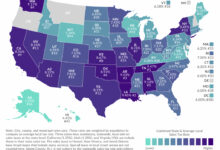

Current Sales Tax Rates Across California

The total sales tax rate in California varies widely due to local add-on taxes. While the state-imposed base rate is 7.25%, local jurisdictions can add anywhere from 0.1% to over 3%. This means consumers in different cities can pay vastly different amounts on the same purchase.

Statewide Average and Range

As of 2024, the average combined sales tax rate in California is approximately 8.82%. However, the lowest rate in the state is 7.25% (in areas with no local additions), while the highest reaches 10.75% in cities like Santa Fe Springs and Alameda. These high rates are often due to voter-approved special district taxes for transportation, public safety, or infrastructure projects.

- Los Angeles: 9.5%

- San Francisco: 8.625%

- Sacramento: 8.75%

- San Diego: 7.75%

- Bakersfield: 8.25%

These differences can influence consumer behavior, with some shoppers crossing city lines to make large purchases in lower-tax areas—a phenomenon known as “tax shopping.”

How Local Jurisdictions Add to the Rate

Local governments in California have the authority to impose additional sales taxes through voter-approved measures or legislative action. These are often referred to as “district taxes” and can fund specific projects or services. For example:

- Measure R in Los Angeles County added a 0.5% sales tax to fund transportation improvements.

- Alameda County has a 1% parcel tax for public safety.

- Special transit districts may levy additional 0.25% to 1% taxes.

These local additions are why two neighboring cities can have significantly different total rates. The CDTFA maintains an online rate lookup tool that allows users to search by address or ZIP code to find the exact rate applicable to a location.

sales tax in california – Sales tax in california menjadi aspek penting yang dibahas di sini.

History of Sales Tax in California

The sales tax in California has evolved significantly since its inception. Understanding its history helps explain why the system is so complex today and how economic and political factors have shaped its development.

Origins and Early Development

California first introduced a statewide sales tax in 1933 during the Great Depression. The initial rate was 2.5%, designed as a temporary measure to boost state revenue during a time of fiscal crisis. However, like many temporary taxes, it became permanent. By 1935, the rate had increased to 3%, and over the decades, it continued to rise in response to growing state expenditures.

- 1933: First sales tax enacted at 2.5%.

- 1941: Rate increased to 3%.

- 1961: Reached 4%.

- 1980s: Rose to 6% amid budget pressures.

The tax was initially straightforward, but as local governments sought more funding autonomy, the system began to fragment.

Major Reforms and Rate Changes

Over the years, several key legislative actions have reshaped the sales tax landscape in California. One of the most significant was Proposition 1A in 2004, which allowed local governments to impose special sales taxes with voter approval. This led to a surge in local add-on taxes, particularly for transportation and public safety.

- 1991: Sales tax increased to 7.25%, where it remains today as the base state rate.

- 2009: During the Great Recession, the state temporarily increased the rate to 8.25%, but it was later reduced.

- 2012: Proposition 30 added a temporary 0.25% tax on sales, later extended.

These changes reflect the state’s reliance on sales tax as a flexible revenue tool, especially during economic downturns.

sales tax in california – Sales tax in california menjadi aspek penting yang dibahas di sini.

What Is Taxed and What Is Exempt?

Not all goods and services are subject to sales tax in California. The state has a detailed list of taxable and exempt items, which can be confusing for both consumers and businesses.

Taxable Goods and Services

Most tangible personal property sold at retail is subject to sales tax. This includes:

- Clothing and footwear

- Electronics and appliances

- Furniture and home goods

- Automobiles (though vehicle sales are subject to a separate use tax)

- Digital products like downloaded music, software, and e-books

In recent years, California has expanded the definition of taxable items to include digital goods, reflecting changes in consumer behavior. The CDTFA clarified in 2015 that digital downloads are taxable, aligning with national trends.

Common Exemptions

California provides several exemptions to reduce the tax burden on essential goods and services. These include:

- Unprepared food (groceries)

- Prescription medications

- Medical devices prescribed by a doctor

- Items purchased for resale (with proper documentation)

- Nonprofit organization purchases (under certain conditions)

It’s important to note that while groceries are generally exempt, prepared food from restaurants or grocery store hot bars is taxable. This distinction can be a source of confusion for both retailers and customers.

sales tax in california – Sales tax in california menjadi aspek penting yang dibahas di sini.

“California’s exemption list aims to protect low-income households from regressive taxation on basic necessities.” — California Budget & Policy Center

Sales Tax vs. Use Tax

While sales tax is widely understood, use tax is less known but equally important. Both apply to the same types of transactions but under different circumstances.

Understanding Use Tax

Use tax applies when sales tax wasn’t collected at the time of purchase, typically in out-of-state or online transactions. For example, if a California resident buys a laptop from an online retailer that doesn’t collect California sales tax, the buyer is responsible for paying use tax directly to the state.

- Use tax rate equals the combined sales tax rate of the buyer’s location.

- It applies to both tangible goods and digital products.

- Businesses must self-report and pay use tax on taxable purchases where no tax was collected.

The CDTFA encourages voluntary compliance through the annual tax return, where individuals can report and pay use tax.

When Each Applies

The key difference lies in who collects the tax:

- Sales tax: Collected by the seller when the transaction occurs within California.

- Use tax: Paid by the buyer when the seller doesn’t collect sales tax, often in remote or online sales.

With the rise of e-commerce, use tax has become increasingly relevant. The 2018 Supreme Court decision in South Dakota v. Wayfair, Inc. allowed states to require out-of-state sellers to collect sales tax, significantly reducing the burden of use tax for consumers. California responded by enacting economic nexus laws, requiring online retailers with over $100,000 in sales or 200 transactions annually to collect tax.

sales tax in california – Sales tax in california menjadi aspek penting yang dibahas di sini.

Impact on Businesses

The sales tax in California presents both challenges and responsibilities for businesses, especially those engaged in retail or e-commerce.

Registration and Compliance Requirements

Any business selling taxable goods or services in California must register with the CDTFA and obtain a seller’s permit. This applies even to out-of-state sellers with economic nexus. Failure to comply can result in penalties, interest, and audits.

- Register online via the CDTFA’s online services portal.

- Collect the correct tax rate based on the buyer’s location.

- File regular returns (monthly, quarterly, or annually).

- Keep detailed records for at least four years.

Small businesses often struggle with the complexity of rate determination, especially when selling across multiple jurisdictions.

Challenges for E-commerce and Remote Sellers

The growth of online shopping has made sales tax compliance more complex. With the Wayfair decision, California now requires remote sellers to collect tax if they meet economic thresholds. This has led to:

- Increased administrative burden for small online retailers.

- Greater reliance on automated tax software like Avalara or TaxJar.

- More accurate tax collection, leading to higher state revenues.

Many businesses now use integrated point-of-sale systems that automatically calculate and remit the correct tax, reducing errors and compliance risks.

sales tax in california – Sales tax in california menjadi aspek penting yang dibahas di sini.

Recent Changes and Future Trends

The sales tax in California continues to evolve in response to technological, economic, and legislative changes.

2023–2024 Legislative Updates

In recent years, California has focused on modernizing its tax system to keep pace with the digital economy. Key developments include:

- Expansion of taxability to include more digital goods and streaming services.

- Clarification of tax rules for subscription-based models.

- Increased enforcement on marketplace facilitators like Amazon and Etsy.

In 2023, the CDTFA issued new guidance on the taxation of software as a service (SaaS), confirming that most SaaS transactions are not subject to sales tax unless they involve tangible personal property.

Potential Future Reforms

Looking ahead, several reform proposals are under discussion:

- Streamlining local tax rates to reduce complexity.

- Expanding the sales tax base to include more services, which currently make up a large portion of the economy.

- Implementing a statewide uniform rate to eliminate disparities between jurisdictions.

However, any major reform would require legislative approval and could face opposition from local governments reliant on sales tax revenue.

sales tax in california – Sales tax in california menjadi aspek penting yang dibahas di sini.

How to Calculate Sales Tax in California

Accurately calculating sales tax is essential for both consumers and businesses. The process involves determining the correct combined rate and applying it to the taxable amount.

Step-by-Step Calculation Guide

To calculate sales tax in California:

- Determine the buyer’s location (city and ZIP code).

- Use the CDTFA’s rate lookup tool to find the combined state, county, city, and district rates.

- Multiply the taxable sale amount by the total tax rate (expressed as a decimal).

- Add the tax amount to the sale price.

For example, a $100 purchase in Los Angeles (9.5% rate) would incur $9.50 in sales tax, for a total of $109.50.

Tools and Resources for Accuracy

To ensure accuracy, businesses and individuals can use:

- CDTFA’s official tax rate lookup tool

- Third-party tax automation software (e.g., TaxJar, Avalara)

- POS systems with built-in tax calculation

- Mobile apps that provide real-time rate updates

These tools help prevent underpayment or overpayment, which can lead to audits or customer dissatisfaction.

sales tax in california – Sales tax in california menjadi aspek penting yang dibahas di sini.

What is the current base sales tax rate in California?

The current base state sales tax rate in California is 7.25%. However, local jurisdictions can add additional taxes, making the total rate vary from 7.25% to over 10.75% depending on the location.

Are groceries taxed in California?

No, unprepared groceries are exempt from sales tax in California. However, prepared food from restaurants or grocery store hot bars is subject to sales tax.

Do I need to pay sales tax on online purchases?

sales tax in california – Sales tax in california menjadi aspek penting yang dibahas di sini.

Yes, if the online retailer has economic nexus in California (over $100,000 in sales or 200 transactions annually), they are required to collect sales tax. If they don’t, you may owe use tax directly to the state.

How do I register for a seller’s permit in California?

You can register for a seller’s permit online through the California Department of Tax and Fee Administration’s website at cdtfa.ca.gov. The process is free and can be completed in a single session.

Can local governments change sales tax rates?

Yes, local governments in California can impose additional sales taxes through voter-approved measures or legislative action. These are often used to fund local projects like transportation, public safety, or infrastructure.

Understanding the sales tax in California is crucial for anyone living in, doing business in, or purchasing goods from the state. With its complex mix of state and local rates, evolving digital economy rules, and ongoing legislative changes, staying informed helps ensure compliance and financial preparedness. Whether you’re a consumer, entrepreneur, or policy observer, knowing how sales tax works empowers smarter decisions.

Further Reading: