Sales Tax NYC: 7 Shocking Truths You Need to Know Now

Navigating the world of sales tax in New York City can feel like decoding a cryptic puzzle. From fluctuating rates to hidden surcharges, understanding the full picture is crucial for both residents and businesses. Let’s break it down—clearly and completely.

Sales Tax NYC: The Basics You Can’t Ignore

The term sales tax NYC refers to the combined state and local taxes applied to most retail purchases in New York City. Unlike some states with a single flat rate, NYC’s sales tax is a layered system involving multiple jurisdictions—state, city, and special districts. This means the final rate you pay isn’t just one number; it’s a sum of several components.

What Exactly Is Sales Tax?

Sales tax is a consumption tax imposed by the government on the sale of goods and services. In the U.S., it’s primarily collected at the point of sale by retailers and then remitted to the appropriate tax authorities. In New York City, this tax is mandatory for most tangible personal property and certain services.

According to the New York State Department of Taxation and Finance, sales tax applies to both in-person and online purchases made from vendors operating within the state.

Current Sales Tax Rate in NYC (2024)

As of 2024, the total combined sales tax rate in New York City is 8.875%. This breaks down as follows:

- 4% – New York State tax

- 4.5% – New York City local tax

- 0.375% – Metropolitan Commuter Transportation District (MCTD) surcharge

This rate applies to most purchases, including clothing, electronics, furniture, and prepared food. However, there are notable exceptions and exemptions, which we’ll explore in depth later.

How Sales Tax NYC Differs From Other Major Cities

Compared to other major U.S. cities, NYC’s sales tax rate is on the higher end. For example:

- Los Angeles, CA: 9.5%

- Chicago, IL: 10.25%

- Austin, TX: 8.25%

- Seattle, WA: 10.1%

While NYC isn’t the highest, its rate is still significant—especially when combined with high living costs. What makes sales tax NYC unique is the inclusion of the MCTD surcharge, which funds public transit infrastructure in the metropolitan area.

Who Collects and Enforces Sales Tax NYC?

The collection and enforcement of sales tax NYC is managed by the New York State Department of Taxation and Finance (NYSDTF). This agency oversees tax registration, filing, audits, and enforcement for all businesses operating in the state, including those in NYC.

The Role of the NYSDTF

The NYSDTF is responsible for ensuring compliance with state tax laws. Businesses must register with the department before collecting sales tax. Once registered, they are issued a Certificate of Authority, which legally permits them to collect tax from customers.

The department also conducts regular audits to verify that businesses are accurately reporting and remitting taxes. Non-compliance can result in penalties, interest, and even criminal charges in extreme cases.

Local Enforcement and Audits

While the state handles most enforcement, local authorities in NYC—including the Department of Finance—can also conduct audits, especially for businesses that operate in multiple jurisdictions or have complex tax obligations.

For example, a restaurant with multiple locations across boroughs may be subject to both state and city-level scrutiny. Audits typically review sales records, exemption certificates, and tax filings to ensure accuracy.

Penalties for Non-Compliance

Failing to collect or remit sales tax NYC can lead to severe consequences. Common penalties include:

- Failure to file: 5% of unpaid tax per month, up to 25%

- Late payment: 0.5% interest per month on overdue amounts

- Fraudulent filing: Fines up to $1,000 or 20% of underpaid tax

Businesses found deliberately evading taxes may face criminal prosecution under New York State law.

What Items Are Taxable Under Sales Tax NYC?

Not all purchases are subject to sales tax NYC. While most tangible goods are taxable, there are important exceptions. Understanding what’s taxable—and what’s not—can save consumers and businesses thousands of dollars annually.

Taxable Goods and Services

The following items are generally subject to the full 8.875% sales tax rate in NYC:

- Clothing and footwear priced over $110 (more on this below)

- Electronics (phones, laptops, TVs)

- Furniture and home appliances

- Prepared food and beverages from restaurants

- Hotel stays (subject to additional occupancy taxes)

- Personal care services (salons, spas)

It’s important to note that even digital goods—like software downloads and streaming subscriptions—are now taxable in New York State.

Exemptions and Tax-Free Items

Several categories of goods are exempt from sales tax NYC, including:

- Unprepared food (groceries)

- Prescription medications

- Most clothing and footwear under $110 per item

- Items purchased for resale (with proper documentation)

- Goods used in manufacturing or production

For example, if you buy a $90 pair of sneakers, no sales tax applies. But if you purchase a $120 jacket, the entire amount is taxed at 8.875%.

The Clothing Tax Loophole: How It Works

One of the most misunderstood aspects of sales tax NYC is the clothing exemption. Many assume that only the amount over $110 is taxed, but that’s not the case. If an individual clothing item costs $110.01 or more, the entire price is subject to tax.

For instance:

- Item: $109.99 → No tax

- Item: $110.00 → No tax

- Item: $110.01 → 8.875% tax on $110.01

This rule applies per item, not per transaction. So buying ten $100 shirts still results in no tax, but one $115 shirt is fully taxable.

Online Shopping and Sales Tax NYC

The rise of e-commerce has dramatically changed how sales tax NYC is collected. Thanks to the 2018 U.S. Supreme Court decision in South Dakota v. Wayfair, Inc., states can now require out-of-state sellers to collect sales tax—even if they don’t have a physical presence in the state.

How Wayfair Changed Everything

Before the Wayfair ruling, online retailers like Amazon or Etsy sellers could avoid collecting sales tax in states where they lacked a physical store or warehouse. This created an uneven playing field between local brick-and-mortar stores and online vendors.

After the decision, New York State implemented economic nexus laws. Now, any seller with more than $500,000 in annual sales or 100+ separate transactions in New York must collect and remit sales tax—including sales tax NYC for city-based purchases.

Do You Pay Sales Tax on Amazon in NYC?

Yes. Amazon has long collected sales tax NYC for all purchases shipped to New York addresses. This includes items sold directly by Amazon and those sold by third-party merchants using Fulfillment by Amazon (FBA).

However, if a third-party seller ships directly from outside New York and doesn’t meet the economic nexus threshold, they may not collect tax. In such cases, the buyer is technically responsible for paying use tax—a topic we’ll cover later.

Marketplace Facilitator Laws in New York

New York has a robust marketplace facilitator law. This means platforms like Amazon, eBay, Etsy, and Walmart.com are responsible for collecting and remitting sales tax on behalf of third-party sellers who use their platforms.

This law simplifies tax compliance for small sellers and ensures that sales tax NYC is collected consistently, regardless of where the seller is located.

Use Tax: The Hidden Twin of Sales Tax NYC

While sales tax NYC is collected at the point of sale, use tax applies when sales tax wasn’t collected—but should have been. It’s essentially the same rate (8.875%) but paid directly by the consumer to the state.

When Do You Owe Use Tax?

You owe use tax in situations such as:

- Purchasing goods online from an out-of-state vendor who didn’t collect NY sales tax

- Buying items while traveling outside New York and bringing them back for use

- Ordering software or digital products from a company not registered in NY

For example, if you buy a $200 designer bag from a website based in Oregon (which has no sales tax) and ship it to your NYC apartment, you owe $17.75 in use tax.

How to Report and Pay Use Tax

Individuals can report use tax on their New York State income tax return. Form IT-201 (for residents) includes a line for “NYS Use Tax” and another for “NYC Use Tax.”

Alternatively, you can file Form ST-100, Sales and Use Tax Return, directly with the NYSDTF. Businesses that make frequent out-of-state purchases often set up regular use tax filings.

Enforcement of Use Tax

Historically, use tax has been under-enforced due to the difficulty of tracking individual purchases. However, the state has increased efforts in recent years, using data analytics and third-party reporting to identify non-compliance.

In 2022, the NYSDTF launched a campaign encouraging taxpayers to self-report unpaid use tax, offering penalty relief for voluntary disclosures.

Sales Tax NYC for Businesses: Compliance Made Simple

For businesses operating in New York City, understanding and complying with sales tax NYC is not optional—it’s a legal requirement. Whether you run a food truck in Queens or a boutique in SoHo, here’s what you need to know.

Registering for a Sales Tax Certificate

All businesses that sell taxable goods or services in NYC must register with the NYSDTF and obtain a Certificate of Authority. Registration can be done online via the New York State Business Express portal.

The process requires basic business information, including EIN, business structure, and expected sales volume.

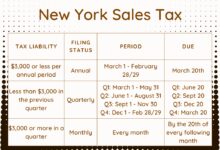

Filing Frequency and Deadlines

Once registered, businesses must file sales tax returns periodically. The filing frequency depends on annual sales volume:

- Monthly: Sales over $150,000/year

- Quarterly: $20,000–$150,000/year

- Annually: Under $20,000/year

Returns are due on the 20th day of the month following the reporting period. For example, a monthly filer must submit their March return by April 20.

Best Practices for Sales Tax Compliance

To avoid penalties and audits, businesses should:

- Maintain accurate sales records for at least three years

- Collect valid exemption certificates from resellers

- Use certified tax software to calculate and file returns

- Train staff on tax policies and procedures

Many businesses use automated solutions like Avalara or TaxJar to ensure accurate sales tax NYC calculations and filings.

Sales Tax NYC and Tourism: What Visitors Need to Know

Tourists and short-term visitors to New York City are also subject to sales tax NYC on most purchases. However, there are nuances worth understanding—especially for international travelers.

Tax on Hotel Stays and Short-Term Rentals

Hotel guests in NYC pay not only the 8.875% sales tax but also additional occupancy taxes. The total tax on hotel stays can reach up to 14.75%, broken down as:

- 8.875% – Sales tax

- 5.875% – Hotel Occupancy Tax

Short-term rentals (e.g., Airbnb) are also subject to these taxes, and hosts are required to collect and remit them.

Can Tourists Get a Sales Tax Refund?

No. Unlike some countries with VAT refund programs for tourists, New York does not offer sales tax refunds to international visitors. Once you pay sales tax NYC, it’s non-refundable—even if you take the item out of the country.

This often surprises travelers from Europe or Asia, where tax-free shopping is common.

Tips for Tourists to Minimize Tax Impact

While you can’t avoid sales tax NYC, you can reduce your burden by:

- Shopping for groceries instead of eating out (groceries are tax-free)

- Buying clothing under $110 to avoid tax

- Using tax-free shopping events (rare in NYC, but check for promotions)

- Comparing prices before and after tax

Remember: Bargain hunting in NYC requires factoring in the full 8.875% cost.

Recent Changes and Future Trends in Sales Tax NYC

The landscape of sales tax NYC is evolving. From digital taxation to economic nexus rules, several recent developments are shaping how tax is collected and enforced.

Expansion of Taxable Digital Goods

In recent years, New York has expanded its definition of taxable goods to include digital products. As of 2023, the following are subject to sales tax NYC:

- Streaming services (Netflix, Spotify)

- Downloadable software and apps

- Cloud-based services with a physical component

This shift reflects the growing importance of the digital economy and ensures that online and offline purchases are taxed more equitably.

Proposed Changes to Clothing Exemptions

There is ongoing debate in the New York State Legislature about modifying the clothing tax exemption. Some lawmakers propose eliminating the $110 threshold entirely, making all clothing taxable to increase revenue.

Others argue for raising the threshold to $200 to provide relief to low- and middle-income families. As of 2024, no changes have been enacted, but the conversation continues.

The Future of Remote Sales and Marketplace Taxes

With e-commerce continuing to grow, New York is expected to strengthen its enforcement of marketplace facilitator laws. Future regulations may require even smaller sellers to collect tax or face stricter reporting requirements.

Additionally, the state is exploring the use of AI and machine learning to detect non-compliant sellers and automate audit processes.

“Sales tax is not just a number at checkout—it’s a reflection of how we fund public services, from schools to subways. In NYC, every 8.875% contributes to the city’s pulse.” — NY State Tax Policy Analyst

What is the current sales tax rate in NYC?

The total sales tax rate in New York City is 8.875%, which includes 4% state tax, 4.5% city tax, and a 0.375% MCTD surcharge.

Are groceries taxed in NYC?

No, unprepared grocery items are exempt from sales tax in NYC. However, prepared food from restaurants or delis is fully taxable.

Do I have to pay sales tax on online purchases shipped to NYC?

Yes, most online retailers are required to collect sales tax NYC on purchases shipped to New York addresses, thanks to economic nexus laws and marketplace facilitator rules.

Can I get a refund on sales tax as a tourist?

No, New York does not offer sales tax refunds to tourists or international visitors.

What happens if a business doesn’t collect sales tax NYC?

The business may face penalties, interest, audits, and legal action from the NYSDTF. Consumers may also be liable for use tax in such cases.

Understanding sales tax NYC is essential for anyone living in, visiting, or doing business in the city. From the 8.875% rate to exemptions on clothing and groceries, the system is complex but navigable. With the rise of e-commerce and digital taxation, staying informed is more important than ever. Whether you’re a shopper, a business owner, or a tourist, knowing how sales tax works ensures you’re prepared, compliant, and financially savvy in the city that never sleeps.

Further Reading: